How can the energy industry provide secure, sustainable and affordable energy to the world? Max Brouwers, Getech’s Chief Business Development Officer, rounds up his key learnings and observations from this year’s five-day global industry summit, CERAWeek 2023.

Key Take-Aways:

- Securing energy supply is a priority and creates opportunities

- New sources of metal (such as copper) need to be found

- Existing technologies can deliver quick decarbonisation wins

- Hydrogen, CCS and synthetic fuel can be easily scaled

“It is not technology, but the alignment of people and leadership that is the deciding factor in whether we mitigate climate change.”

Lord John Browne, former CEO, BP

Securing energy supply is a priority

Russia’s invasion of Ukraine has put attention back onto the importance of reliable sources of energy and raw materials. Arguably, until a year ago, Europe was too focussed on decarbonisation rather than affordability and security, and the need for diversity in geography and technology has been a lesson hard learned. This renewed focus on energy security puts pressure on supply chains and pricing, but on the upside, the emphasis on reliability can create opportunities for organisations that can quickly locate and develop new natural resources.

IRA is a game-changer: EU take note

In the USA, the Inflation Reduction Act (IRA, a low carbon energy stimulus of $369 billion) is an incentive ‘carrot’ that is massively accelerating energy transition and creating attractive investment conditions for clean tech. In contrast, the European ‘stick’ approach is being seen as complex and prescriptive. Some expect that the EU will make further adjustments to be more in line with IRA, while other parts of the world will need to find their own policy answers to stimulate the energy transition to meet their national commitments.

Infrastructure and bureaucracy need to keep up

The slow speed at which permits are being issued is holding back energy transition. In the USA it can take over ten years to get a project started, and by that time many of the benefits provided by IRA will have run out. Renewables projects are also being held back by delayed upgrades to the transmission grid – it’s being said that right now there are more projects waiting for a grid connection than are up and running.

Metals are the new oil

Energy transition relies on the availability of metals, and so far 700 million tonnes of copper have gone towards achieving net zero around the world. Another 700 million tonnes will be needed over the next 27 years, yet existing mines cannot deliver the required resources – not just for copper, but for other metals too. New sources need to be identified and opened in politically accessible locations.

“We need to switch from a hydrocarbons-intensive ecosystem to a minerals and metals-intensive ecosystem, and that is still not there.”

Tengku Muhammad Taufik, President & Group CEO, Petronas

Oil and gas are not gone yet

Understandably, oil and gas CEOs stressed that for energy transition to be orderly (with energy supply able to meet demand at a reasonable cost) fossil fuels will still be required for decades to come. Switching to natural gas, and LNG (liquefied natural gas) in particular, can be used to replace some higher-polluting energy sources, such as coal-fired powerplants in China or India.

Financing energy transition is still a daunting challenge

Between US$ 2.5 trillion and US$4 trillion of investment in renewable energy will be needed each year to reach net zero by 2050. Yet projects that require large upfront investments and have slow pay-back timelines do not attract venture capital, instead private-public funding is the preferred option. And thanks to escalating interest rates and rising steel and silicon prices (vital for wind turbines and solar panels), investors may be increasingly cautious about moving more funds into renewables.

Techno-optimism is justified

The technologies that we need to achieve net zero exist, at least in the lab. The challenge is to scale them for commercial deployment at a pace that enables climate goals to be met. This requires more collaboration, more risk-taking, and more policies that incentivise and accelerate implementation, especially over the next five years.

“Many digital technologies are making our energy systems today more affordable, reliable, and even cleaner.”

Eimear Bonner, President & CTO, Chevron Technical Centre

Existing technologies such as methane reduction, digitalising operations and implementing no–leak valves, could all deliver quick wins.

Energy companies can pivot to cleaner approaches

Electrification cannot satisfy all energy needs. Industries that currently rely on fossil fuels for high-temperature energy or chemical feedstocks (iron and steel, cement, chemicals) can be decarbonised using hydrogen, synthetic/biofuels in combination with carbon capture and storage (CCS). Hydrogen, CCS and synthetic fuels can be easily scaled by oil and gas companies, as they leverage the same talent, business models, and physical infrastructure.

CCS is at a turning point

To meet global climate goals CCS must increase by 200 times its current rate. The good news is that an increase is expected, with up to 30 CCS hubs around the world awaiting an investment decision this year (although the financial model remains challenged, especially in countries with no firm price for CO2). Financial and insurance institutions have not yet done their homework on long-term risk and are not yet ready to step up.

Hydrogen is happening

Hydrogen has moved from the theoretical to the practical, with production projects now up and running. Rather than talking about hydrogen colour, the discussion has moved on to the carbon intensity of production, a much more useful metric. The preferred mechanisms for international transportation now appear to be ammonium and synthetic methane. And having bankable offtake schemes in place is a key factor in obtaining finance, reducing the perception of risk.

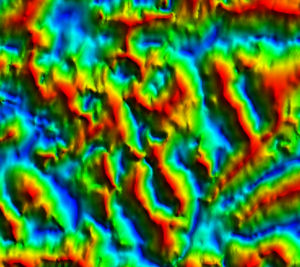

Geothermal is looking good

Geothermal technologies continue to progress, such as new drilling techniques and subsurface de–risking. The return of ‘big oil’ is providing access to operational expertise and project management skills. Policy changes, such as IRA, mean that geothermal is back on a level playing field with wind and solar, and private capital is coming in to help fund projects.

“Energy Transition comes down to technology, not ideology”

Brendan Bechtel, Bechtel CEO

Digitalisation is the key enabler

Effective digitalisation focusses not just on technology, but also people, decision–makers and operating models. It all starts with a well-structured and secure database. Data scientists need to be embedded within organisational teams, and the wider organisation needs to be upskilled in order to benefit from improved workflows and automation.

Get in touch to find out how Getech can help your organisation achieve net zero.

Written by Max Brouwers, Getech’s Chief Business Development Officer.